|

| Credit: betanews.com |

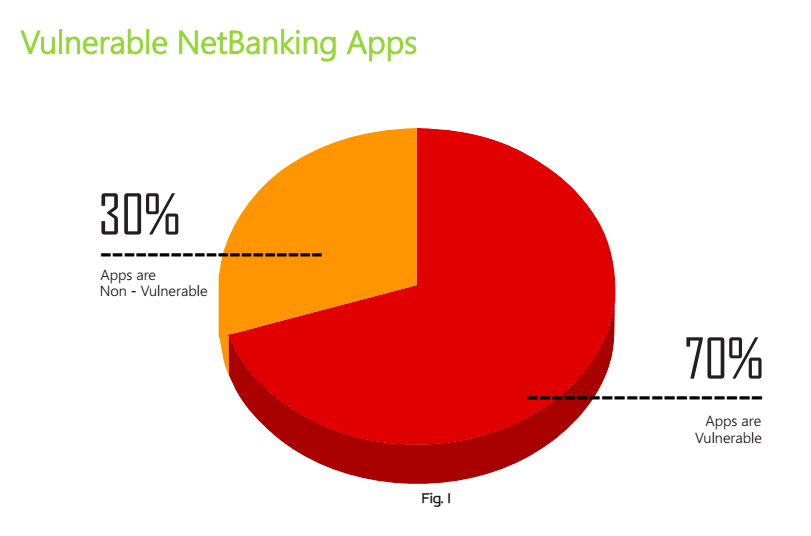

People are becoming increasingly concerned about their security. They

use two-step authentication, login alerts, and third-party security

services to better protect their email and social media accounts. One

would hope for a similar -- if not more secure -- level of protection

from our banks. After all, this is the place where we put most of our

earnings and savings. However, apparently we are all mistaken. Mobile

security firm Appvigil is reporting

that as many as 70 percent of the top 100 mobile banking apps on the

Android operating system in the APAC region are vulnerable to security

attacks and data leaks.

Don’t live in the said region? That’s no reason

to relax. The report further pinpoints vulnerabilities in mobile banking

apps found in other regions as well.

The security firm tested the mobile banking apps of the top 29 Indian

banks and 71 more in the Asia Pacific region and the results are

staggeringly bad. "Most of the mobile banking apps failed and many

didn’t employ even the basic security checks expected. The communication

between the apps & their servers is still in the unencrypted format

i.e. in HTTP instead of HTTPS", the report reveals.

In the past couple of years as security threats reached new heights,

most of the banks in European and American regions implemented security

measures such as authentication using e-tokens, one-time passwords

(OTP), and confirmation of transactions through codes sent to Android

phones, but as Appvigil points out -- which is in line with news reports

we have seen previously -- cybercriminals have developed tools that

bypass these measures.

"There are numerous ways by which security loopholes can arise in an

Android application. Organizations today, are focusing more on state of

the art features, responsive and performance optimization issues without

paying much heed to security. In most of the cases people react to

security issues only when they face some discrepancies via a malicious

threat agent", the report adds.

Furthermore, the report chalks out loopholes -- such as issues of

system clock accuracy, and time synchronization -- arising due to

ignorance by our carriers and network admins. "If certain processes run

out of sequence, such as transaction processing and backups, then the

results of these processes may cause discrepancies, due to the

transaction times failing to tally. Mismatched timestamps often cause

financial and database program errors".

The firm found a staggering 983 security vulnerabilities in the 100

mobile banking apps it tested. These vulnerabilities include exploits

such as intent spoofing, unintended data leakage, SQL injection,

JavaScript injection, XML injection, and unencrypted sockets among

others. "The findings of our analysis presented in this report have a

different story to tell. It's evident from the report that most of the

apps are vulnerable to security attacks with 82 percent of apps carrying

high severity vulnerabilities in them. On an average, 14 security bugs

per app are present. Surprisingly, we found five mobile banking apps

which had more than 50 security vulnerabilities in each of them". You

can read more about it here.

You should be concerned about this even if you don’t live in the APAC region. Gizmodo did a comprehensive rundown

of existing security measures utilized by all major banks in the United

States and other regions, and the results were woeful. We contacted

AVG, a popular mobile security firm to see what they think about this

report. "There are banking apps in many markets which can be vulnerable

to compromise but we are aware that banks do prioritize working on a fix

obviously", Yuval Ben-Itzhak, CTO at AVG tells BetaNews.

"An example of one of these vulnerabilities is where an app downloads

data and caches it on the device in multiple places. Some of these

files may be able to be accessed by other apps and may not be removed

after the banking app has used them. An uninstaller app would help

ensure such data is removed for security purposes. Another example would

be where an app is using a vulnerable WebView component, such as on a

version of Android that is earlier than 4.1, which may leave it open to

risk.", he added.

Source:

No comments:

Post a Comment